Is leasing a car ever financially sound?

Published:

This post was meant for TeslaModelY subreddit, since this place already has many good ones and not so good ones discussiong on the topic. But I wasn’t able to to share my perspective there, so I doing it here, mostly for my future self.

The question I would like to answer is simple: if you have decided to buy a brand new Tesla Model Y today, and you’re likely to sell the car in ~3 years, should you choose leasing or financing/cash and sell the car yourself? There is an established opinion that current leasing deal is very good and risks related to fast EV depriciation make leasing a better choice. However, to me, it seems obvious that financing is a better financial decision than leasing.

If I had to narrow it down to the single most important reason why financing is better: a lease buyout does not let you use the $7,500 tax credit. Leasing without buying out is basically treating your car like an iPhone — something you should only do if you’re extremely wealthy.

Disclaimer 1: My conclusion does not apply if you don’t qualify for the $7,500 tax credit.

Disclaimer 2: Even if you structure your financing or leasing differently (e.g., putting $0 down), the main conclusion doesn’t change: financing is still cheaper. However, it’s obvious that you should put down all the free money you have in your savings account, since the finance APR is 3.99% and the lease APR is 7.9%, while savings accounts are only yielding around 3.65% these days. For simplicity, I put the maximum allowed amount down in the lease case and matched it in the finance case to make an apples-to-apples comparison.

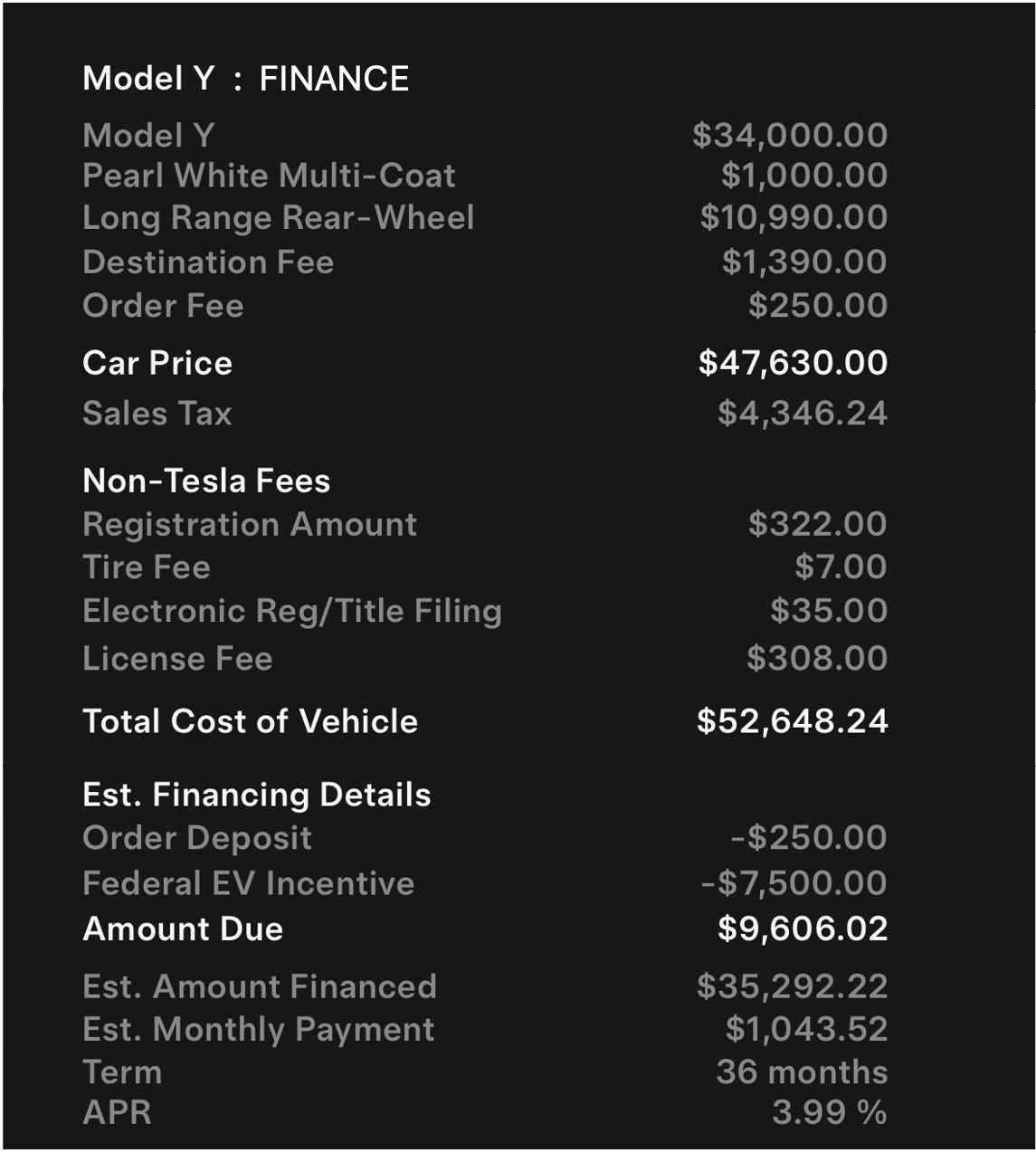

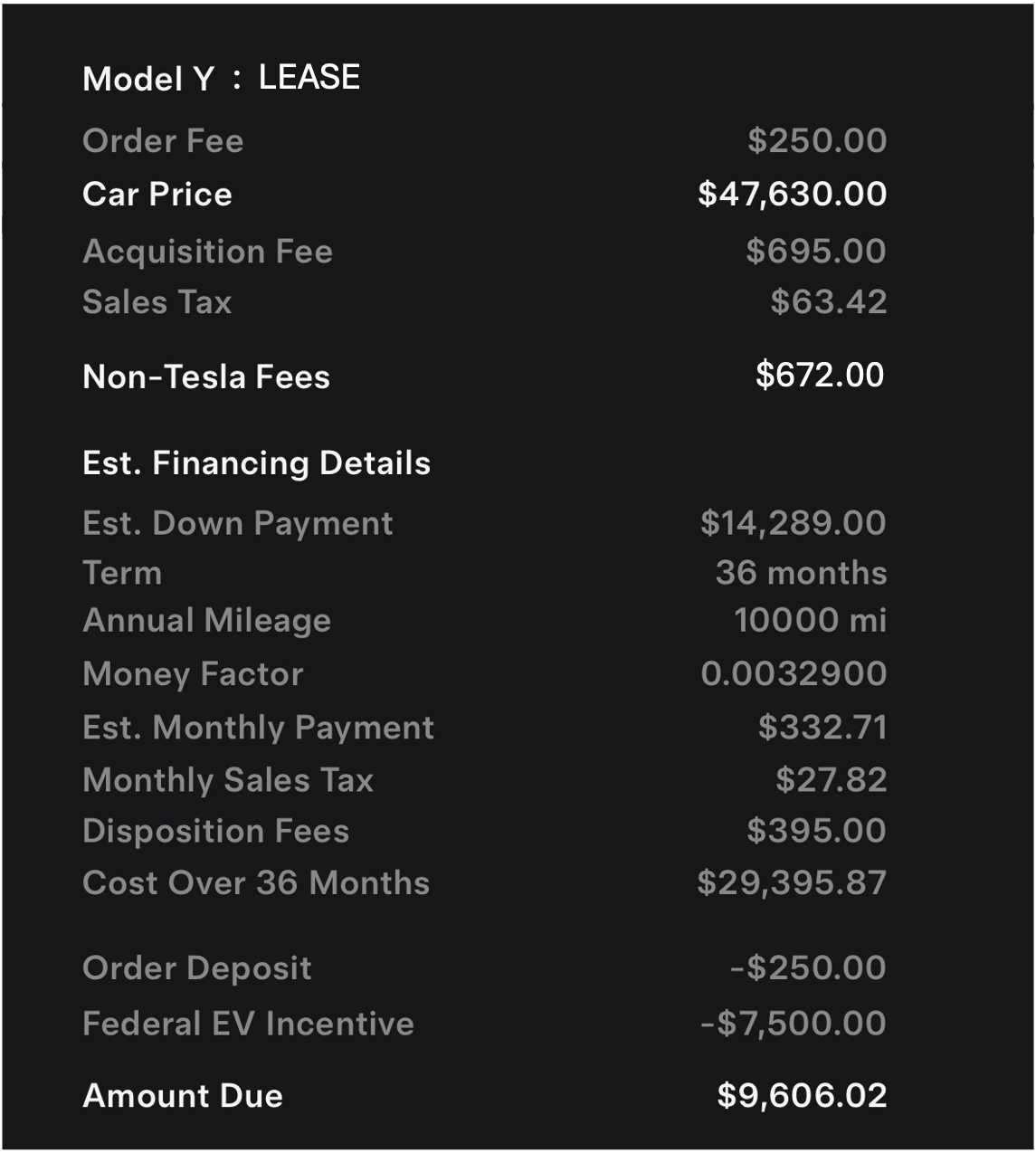

Attached are the numbers I pulled from the Tesla app for the Long-Range Rear-Wheel Drive as of September 2025 in California. Below, I go through the exact calculations for myself, because I want to understand how Tesla comes up with the numbers they present.

| Finance | Lease |

|---|---|

|  |

TOTAL CAR PRICE BREAKDOWN

Let me note that the full price of the car includes taxes and goverment fees such as registation (which are non taxable)

| Item | Cost |

|---|---|

| Car price | $47,630 |

| Registration-like fees (non-taxable) | $672 |

| Car price + fees | $48,302 |

| Sales tax (9.125%) | $47,630 * 9.125% = $4,346 |

| Car price + fees + taxes | $52,648 |

FINANCING

| Item | Finance |

|---|---|

| Total car cost | $52,648 |

| Downpayment #1 (federal tax credit) | $7,500 |

| Downpayment #2 (order fee) | $250 |

| Downpayment #3 (you decide how much) | $9,606 |

| Total downpayment | $17,356 |

| Due at signing | $9,606 |

| Loan (car cost - down payments) | $35,292 |

| APR | 3.99% |

| Monthly payments | $1,043 |

| Total interest paid | $2,256 |

Math behind monthly payments is not complicated: the amount you owe is converted to monthly payments using present value formula. Simple calculation yields $1,041.81 while Tesla app estimates $1,043.52 🤷♀️ well, close enough, I guess

LEASING

I tried to reverse-engineer Tesla’s leasing numbers, but they don’t match exactly. I’m not sure what residual value Tesla assumes—if you know, please share. According to Tesla.com, a $45,990 + tax Model Y would cost $29,849 + tax to buy out at the end of the lease, which is exactly 65% of its value. However, in my calculations I had to assume a 60% residual to get monthly payments close to Tesla’s estimates.

| Item | Lease |

|---|---|

| Car cost (without taxes and registration) | $47,630 |

| Downpayment #1 (tax credit) | $7,500 |

| Downpayment #2 (order fee) | $250 |

| Downpayment #3 (max allowed) | $6,539 |

| Total downpayment (Tesla app screenshot) | $14,289 |

| Due at signing (includes other fees) | $9,606 |

| Adjusted cap cost (cost - downpayment) | $33,341 |

| Residual value (60% of car cost) | $28,578 |

| Depreciation (adj cap cost - res value) | $4,763 |

| Monthly depreciation fee | $132.3 |

| Loan amount (adj cap cost + res value)/2 | $30,960 |

| Money factor (MF) | 0.00329 |

| Effective APR (2400*MF) | 7.9% |

| Monthly finance fee = MF*(Loan amount)*2 | $203.7 |

| Total interest paid (finance fee * 36 months) | $7,333 |

| Total monthly payment (depreciation + finance) | $336 |

| Total monthly payment + tax | $367 |

| Monthly payments over 36 months | $13,200 |

| Cost over 36 months (due at signing + all monthly payments + order fee) | $23,056 |

| Buy-out price (res value + tax) | $31,186 |

I’m also not sure how ‘due at signing’ price is calculated. If we belive that full downpayment is $14,289, then downpayment without tax credit is $6,539+$250. But how to get to $9,606 that the app estimates? Even when we add registration fees ($672 no tax), acquisition fee ($695 + tax), disposition fee ($395 + tax), first monthly payment ($332 + tax), it only sums up to $9000 🤷♀️ well, close enough, I guess

COST OF 3-YEAR USE

One key variable to estimate is how much the car will actually depreciate (its fair used-market value). According to an April 2025 article, Tesla retains about 65% of its value after 3 years, 60% after 4 years, and 55% after 5 years. Of course, there’s always the possibility that dramatically cheaper EV batteries will be invented and new Tesla prices will drop significantly. Still, it seems reasonable to expect a 2025 Tesla Model Y to have a fair market value of at least $27,000 (56%) in 2028. For comparison, a 2022 Model Y now sells for about $27,000 according to KBB — but that car originally cost $70,000, which is exactly the kind of steep depreciation everyone worries about.

If you finance, you pay $52,650 – $7,500 = $45,150 in total. Assuming you can resell for $27,000 after 3 years, your effective cost of ownership is $45,150 – $27,000 = $18,150. If instead it holds value more like the article suggests (to ~$31,000), then the 3-year cost drops to $14,150.

If you lease, you pay $23,050 over 3 years. To buy the car afterward, you pay the residual value based on the full price (without applying the tax credit). That’s the main reason financing ends up about $5,000 cheaper. Otherwise, lease and finance would be roughly the same. For leasing to come out ahead of financing + resale, the car would need to depreciate by about 51% in 3 years—not impossible, but unlikely.

CONCLUSION

One could argue that paying a hefty premium to lock in a future sale price is a good deal in today’s market. But to me, leasing still looks like a poor financial decision—even if you know you’ll definitely sell in 3 years. A smarter choice would be to either hold the car longer or buy used in the first place.

That said, the current lease deal is still attractive. If you’re wealthy enough not to qualify for the tax credit and just want a new Tesla, it makes sense to take advantage of it. But if you’re a middle-class working person trying to manage your finances rationally, it seems clear to me there’s only one right answer: financing.

We will see in 3 years if I am any good at predictiing future.